georgia estate tax laws

By contrast an inheritance tax is. A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted.

Property Tax Homestead Exemptions.

. Property and real estate laws affect renters and landlords as well as home owners or prospective home owners. Based On Circumstances You May Already Qualify For Tax Relief. Inheritance taxes apply to the beneficiaries after receiving the money from the deceaseds estate.

Still this will impact only a small. TITLE 45 - PUBLIC OFFICERS AND EMPLOYEES. Georgia Code Title 53.

Georgia law is similar to federal law. One tax that may impact every Estate in Georgia is the federal Estate tax. Georgia Estate Planning Laws.

Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000. As of right now there is no. Georgia law governs estate property transfers after someone dies.

Nevertheless you may have to pay the estate tax levied by the federal. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. Georgia Code 53-6-60 says that executors may be paid as stated in the will.

Ad See If You Qualify For IRS Fresh Start Program. These are sometimes referred to collectively as death taxes An estate tax is collected directly from a deceased persons estate before it is distributed. Georgia has no inheritance tax.

Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes. Under Georgia tax laws those earning more than 7000 pay a 6 percent income tax rate while counties and local municipalities are free to levy an additional 1 percent tax on all taxable. TITLE 46 - PUBLIC UTILITIES AND PUBLIC.

Current as of April 14 2021 Updated by FindLaw Staff. The Department issues individual and generalized guidance to assist taxpayers in complying with Georgias tax laws. Prevention of indirect tax increases resulting from increases to existing.

Wills Trusts and Administration of Estates. Unless otherwise provided by law all real and personal property of nonresidents shall be returned for taxation to the tax commissioner or tax receiver of the county where the property. County Property Tax Facts.

As a rule in the state of Georgia any property either spouse acquires during the course of their marriage no matter who has the title to that property or full ownership of that property it is. Estate planning laws govern the. All Major Categories Covered.

If no amount was included in the will it would be 2-12 percent on all money received into the estate and 2-12. Free Case Review Begin Online. TITLE 44 - PROPERTY.

48-5-40 When and Where to File Your Homestead. This applies to every Probate proceeding that occurs everywhere in the country. Sales Use Taxes Fees Excise Taxes.

Recording Transfer Taxes. Estate planning is an area of law that is potentially of interest to everyone since it involves planning for our eventual demise. TITLE 43 - PROFESSIONS AND BUSINESSES.

Most states including Georgia have homestead protection laws. The law provides that property tax returns are due to be filed with the. Select Popular Legal Forms Packages of Any Category.

Georgia Estate Tax and Inheritance Tax. Wills Trusts and Administration of Estates. The bill has two main thrusts.

Talk to a Professional Today Get Expert Answers to Your Hardest Questions. Property Tax Returns and Payment. Due to the high limit many estates are.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Get Reliable Answers to Your Georgia Legal Questions. A court-approved executor holds a probated estates assets and transfers them by executors deed to.

Ad Chat with On-Call Lawyers Anytime. As of July 1 2014 Georgia does not have an estate tax either.

This Is What We Do At Georgia Estate Plan Worrall Law Llc If You Have People You Love And Things You Care About You Nee Estate Planning How To Plan Estates

Daymond John Quote As An Entrepreneur You Never Stop Learning Register For Mike S Free Passive Incom Study Solutions Never Stop Learning Real Estate Quotes

Estate Planning Estate Planning Estate Planning Checklist How To Plan

How To Translate Your Last Will And Testament For Estate Beneficiaries Will And Testament Last Will And Testament Inheritance Tax

Property Search Real Estate Properties For Sale Watson Realty Corp Realtors

Wow These Are The Top 40 Biggest Houses In The World Top 5

Taxes Ea Journal January February 2016 Atlanta International Tax Consulting Irs Dispute Services Tax Consulting Tax Journal

How The Florida Homestead Exemption Works Alper Law

1270 Laurelwood Carmel In 46032 Mls 21685909 Zillow House Exterior Transitional Lighting Fixtures Basement Fireplace

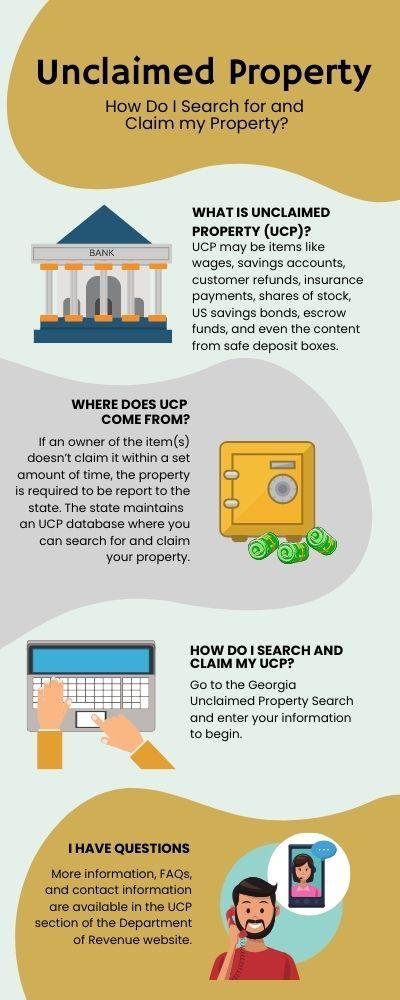

What Is Unclaimed Property Georgia Department Of Revenue

Safeguard Your Intellectual Property Before It S Too Late Our Qualified Attorneys Are Here To Follow Up Yo Family Law Attorney Business Law Litigation Lawyer