does idaho have capital gains tax

Taxes capital gains as income and the rate is a flat rate of 495. However the state does not charge this capital gains tax on the sale of traditional currency no matter how much it might have inflated.

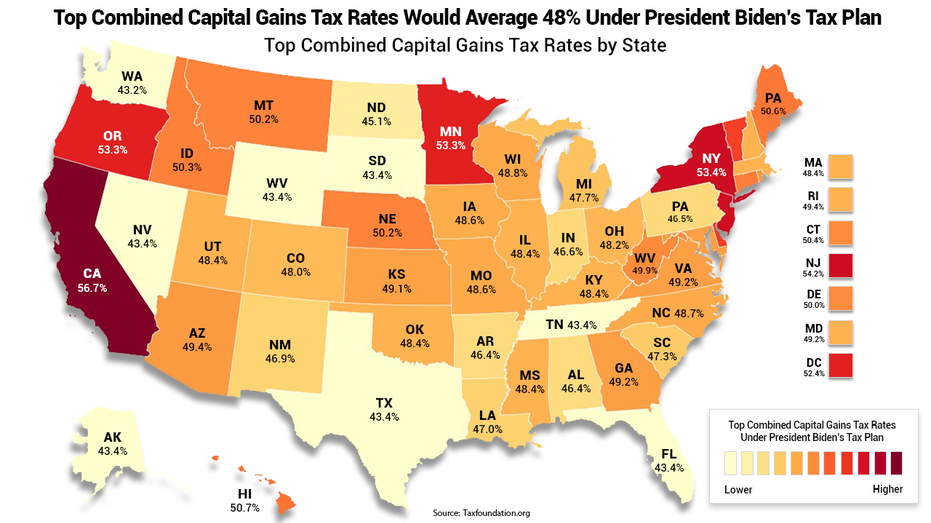

2021 Capital Gains Tax Rates By State Smartasset

Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Idaho.

. The Federal Capital Gains Tax applies to all precious metals. You must complete Form CGto compute your Idaho capital gains deduction. Does Idaho have an Inheritance Tax or an Estate Tax.

The land in Utah cost 450000. The capital gains tax is based on the amount of the gain PLUS other income for the individuals filing status. 208 334-7660 or 800 972-7660 Fax.

Farm capital gains is very complicated. Taxes capital gains as income and the rate reaches 66. Each states tax code is a multifaceted system with many moving parts and Idaho is no exception.

However certain types of capital gains qualify for a deduction. Idahos capital gains deduction Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Your income and filing status make your capital gains tax rate on real estate 15.

Idaho Capital Gains Tax. Additional State Capital Gains Tax Information for Idaho The Combined Rate. There is a Federal Capital Gains Tax in Idaho which is also imposed in the other 49 states.

Idaho axes capital gains as income. In addition while some states do charge capital gains tax on real estate luckily idaho is not one of them. Individuals with taxable income of less than 40400 80800 for married couples filing jointly pay no tax at all on 2021 capital gains.

Additional State Capital Gains Tax Information for Idaho The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. Taxes capital gains as income and the rate is a flat rate of 323. The capital gains rate for Idaho is.

For complete notes and annotations please see the source below. The rate reaches 693. Capital gains tax is the tax that you pay on those capital gains.

500000 for married couple - will not be taxable. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. Real property that is held for at least one year is eligible for a deduction of 60 of the net capital income that is the net gain after expenses.

Idahos maximum marginal income tax rate is the 1st. Box 36 Boise ID 83722-0410 Phone. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent.

Capital gains are taxed as regular income in Idaho and subject to the personal income tax rates outlined above. But the tax rates are not. HB 449 would eliminate the state capital gains tax on the sale of precious metals.

208 334-7660 or 800 972-7660 Fax. Idaho conforms to the IRC as of January 1 2021. The time in which you owned your Idaho house is going to play a role in the type of Idaho capital gains tax you could end up being responsible for.

The Idaho Income Tax. Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed as follows.

Only capital gains from the following idaho property qualify. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. 208 334-7846 taxrep.

The rate reaches 693. In addition while some states do charge capital gains tax on real estate luckily Idaho is not one of them. The percentage is between 16 and 78 depending on the actual capital gain.

Whats great about this tax exclusion is that you can use it every time you sell a primary residence as long as youve lived there for two years and have not used this tax exclusion on another house within the last two years. However a 20 capital gains tax rate applies to 2021 capital gains for individuals with taxable incomes over. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Idaho axes capital gains as income. 52 rows the capital gains tax calculator is designed to provide you an estimate on the cap. Precious metals in bullion form are a constitutional form of money and should be treated as such when it comes to taxation.

State Tax Commission PO. For tangible personal property. What is the capital gains tax on real estate in Idaho.

Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule. Section 63-105 Idaho Code Powers and Duties - General Income Tax.

If your mom had a gain of 580000 after applying the 250000 exclusion her capital gains. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Taxes capital gains as income and the rate reaches 575.

Capital gains are taxable but not all gains are treated the same for tax purposes. For example a single. Taxes capital gains as income and the rate is a flat rate.

This basically states that any profits you make from selling precious metals will incur a tax of as much as 28 with the actual amount depending on your location and income. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. The long-term capital gains tax rate equals 15 for most taxpayers on most types of capital gain.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. The percentage is between 16 and 78 depending on the actual capital gain. Days the property was used in Idaho Days the property was used everywhere.

The general capital gains tax rate for the farm is 15 federal. Taxes capital gains as income and the rate reaches 575. 100000 gain x 5500001000000 55000.

Capital Gains Tax in Idaho. If youve owned the property for one year or less then it falls under the short-term capital gains tax bracket. If all of the gain cannot be excluded and is shown on her tax return that amount is included in the calculation for Medicare premium purposes.

Idahos tax system ranks 17th overall on our 2022 State Business Tax Climate Index. Details on how to only prepare and print a Idaho 2021 Tax Return. The land in Idaho originally cost 550000.

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Historical Idaho Tax Policy Information Ballotpedia

Spin Control Initiative Battle Over Capital Gains Tax May Be Brewing The Spokesman Review

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Solved When You Sell A House Do You Have To Pay Taxes

Two State Senators Propose Doubling New Capital Gains Tax For Financial Managers Washington Bigcountrynewsconnection Com

Trial Court Sides With Super Rich On Capital Gains Tax The Stand

Capital Gains Tax Calculator 2022 Casaplorer

Solved Can You Avoid Capital Gains Taxes On A Second Home

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

How High Are Capital Gains Taxes In Your State Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

2021 Capital Gains Tax Rates By State Smartasset

Capital Gains Tax Passes House Heads To Senate For Concurrence Washington State Wire

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep